Related Post

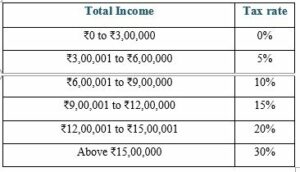

According to the announcement made under the budget, the revised tax slab applies to the new tax regime. The corresponding changes from April 1, 2024, are highlighted below.

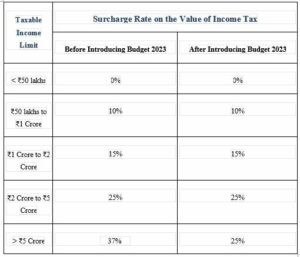

The implementation of the new tax regime leads to a reduction in the surcharge rate from 37% to 25%. This is applicable for individuals with income exceeding Rs.5 Crores.

This reduced surcharge rate is valid only for those taxpayers who choose the new tax regime and have an income exceeding Rs.5 Crores.

The following table shows the updated surcharge rate according to the new tax regime:

The introduction of the new tax regime has increased the rebate limit. As per the old tax regime, the applicable rebate limit is Rs. 12,500 for incomes up to Rs.5 lakhs. However, under the new tax regime, this rebate limit has increased to Rs. 25,000 if the taxable income is less than or equal to Rs.7 lakhs. Note that the Section 87A rebate is applicable under both income tax regimes. Then, the budget announcement increased the taxable limit to Rs.7 lakhs from Rs.5 lakhs under the new tax regime.

Salaried individuals’ standard deduction under both the old and the new regime is Rs. 50,000.

Your Comment