Related Post

বিভ্রান্তিকর বিজ্ঞাপন থেকে সতর্ক থাকুন, প্রতারিত হওয়া থেকে বাঁচুন

Category: Blog

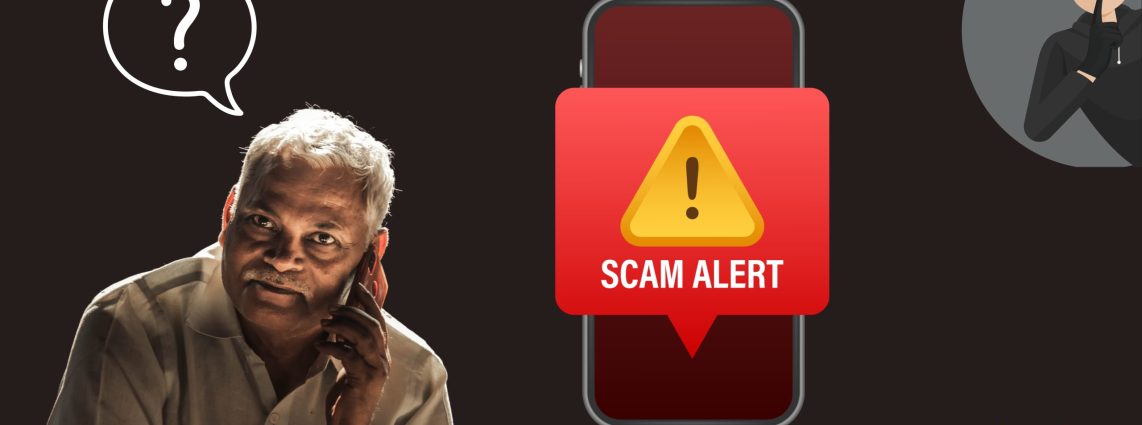

Nowadays financial scam is a global issue. Even 39% Indian families claim to be victim of online financial fraud. Although anyone can be targeted by scammers, there are several factors that put only the senior citizens at high risk. Financial scams targeting seniors have become so prevalent that they’re now considered ‘the crime of the 21st century.’ It’s not just wealthy seniors who are targeted. Low-income older adults are also at the same risk of financial abuse. New cases of financial fraud are coming to light every day from different parts of our country. Cyber-criminals are adopting new ways to trick older people and steal money from UPI fraud to SMS fraud.

Typically, a scammer will deceive citizens with false promises of good service. Once they gain their trust, scam artist goes after financial details, health insurance etc. Only three months ago, 70 years old women from Mumbai was making a purchase of Rs 1169 online, however, Rs 19,005 was debited from her account. She called the bank helpline number but later got duped for a total of Rs 8.3 lakh. According to data from the National Crime Records Bureau report, 2022, forgery, cheating, and fraud (FCF) constitute 11 percent of the crimes committed against senior citizens.

Now the question is why older people are more likely to get scammed?

Type of scam:

Fake insurance: Scammers offer different types of deals regarding insurance, such as life, auto, home in order to obtain the personal details.

Refund scam: Scammers will claim that the person has been given too much money due to an accounting mistake. Then demand the money back.

Fake investment opportunity: An unsolicited call from a fake financial advisor offering a once-in-a-lifetime investment opportunity.

Medicare impersonator: Scammers try to obtain personal information and identity by calling and asking for information in order to issue the seniors a new Medicare card or offer you discounted additional coverage.

Scam messages: sometimes scammers send messages regarding electric bill, telephone bill. They call and ask for payment through a fraud link.

E-Wallet scam: seniors are not well-versed with e-wallets, the scammers are making them the victims of the e-wallet scam. scammers have found various ways of tricking senior citizens into sharing their UPI ID or various sensitive information.

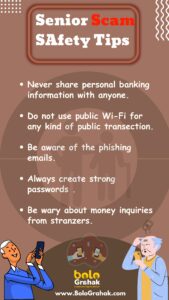

Prevention:

. Be aware of the phishing emails and always do cross-check if they are actual or not.

. ignore the calls who are claiming that you have won a lottery or a prize or something like that.

. Never share personal banking information with anyone such as credit/debit card details, CVV, OTP etc.

. Do not use public Wi-Fi for any kind of public transaction.

. Always create strong passwords for any type of personal account.

However, our seniors may not be tech-savvy but with proper guidance, they can learn about prevention measures to be taken and avoid being scammed. Financial exploitation is just one form of elder abuse. Remember not only are senior people heavily targeted by scammers, but surprising data says that, as we get older, we become more vulnerable to fraud in so many of its forms. So, be alert and stay involved and keep your seniors and loved ones informed of scammers regularly. Remind them not to trust anyone so easily. Most importantly, remind them that they should come to you if they faced any kind of trouble.

Source:(herbrewseniorlife.org, dmifinance.in)

Category: Blog

Your Comment